32+ Tax Calculator Sc

Web The average effective property tax rate in South Carolina is just 05 5 with a median annual property tax payment of. Explore the Collection Of Software At Amazon Take Your Skills To the Next Level.

4076 Babbitt Street Charleston Sc 29414 Mls 23021704 Scctmls

Hisher take home pay will be 4080490.

. Web With an annual salary of 51000 a single filing South Carolinian will have a income tax of 1019510. Web Your federal taxable income is the starting point in determining your state Income Tax liability. Web South Carolina Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

Web South Carolina Salary Paycheck Calculator. When youve got the correct information in. Just enter the wages tax withholdings and other.

Lets build simple tax-free alternatives. Processing payroll for your South Carolina business doesnt have to feel like a chore. Web Data from the SSA shows that the average Social Security benefit in August 2023 was 170579.

Updated on Jul 18. Web Filing 12000000 of earnings will result in 624235 of your earnings being taxed as state tax calculation based on 2023 South Carolina State Tax Tables. Web The South Carolina Salary Calculator updated for 2024 allows you to quickly calculate your take home pay after tax commitments including South Carolina State Tax Federal.

All you need to do is enter wage and W-4 information for each of your. Web The South Carolina Tax Calculator. Free tool to calculate your hourly and salary income after.

Ad Allowances seem easy but waste 30 in taxes. Updated on Sep 19 2023. Individual Income Tax rates range from 0 to a top rate of 7 on taxable.

Web The state income tax rate in South Carolina is progressive and ranges from 0 to 7 while federal income tax rates range from 10 to 37 depending on your. Web South Carolina Personal Income Tax. Ad Get Deals and Low Prices On turbo tax online At Amazon.

If you make 70000 a year living in Hawaii you will be taxed 12921. Web 2022 South Carolina Individual Income Tax Tables Revised 10422. Web South Carolina Salary Tax Calculator for the Tax Year 202324.

Web Use our income tax calculator to estimate how much tax you might pay on your taxable income. You are able to use our South Carolina State Tax Calculator to calculate your total tax costs in the tax year. South Carolina charges a progressive income tax on its residents ranging from 0 at the lowest bracket to 7 at the highest bracket.

Estimate Your Federal and South Carolina Taxes. Use our South Carolina State Tax. Web Calculate your South Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this.

This results in roughly. Web Taxes are delicate which is why it is important for you to use the right tools to calculate how much you owe the government in taxes. Web We designed a handy payroll tax calculator to help you with all of your payroll needs.

Web Hawaii Income Tax Calculator 2022-2023. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Your tax is 0 if your income is less than the 2022-2023 standard deduction.

Web Calculate your Property Taxes. Use our paycheck tax. Part of the reason taxes are so low is that owner.

Web The South Carolina Tax Calculator Select a Tax Year 2021 2022 2023 2024 Select Your Filing Status Single Head of Household Married Filing Joint Married Filing Separately. Its possible and its tax-free. Web Use ADPs South Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Because the COLA increase for Social Security payments is determined by inflation between the third quarter of 2022. Enter your info to see your take home pay. Web Widow er with two children.

A flexible allowance program that adapts to your needs. Discover Helpful Information And Resources On Taxes From AARP. Web The total taxes deducted for a single filer are 83917 monthly or 38731 bi-weekly.

A 3 COLA could increase this by 5117 monthly resulting in. Single Head of Household. C2 Select Your Filing Status.

C1 Select Tax Year. 1250 1300 0 4250 4300 32 7500 7600 131 13500 13600 311 19500 19600 613. Your average tax rate is.

Ad Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Edexcel Igcse Further Pure Maths Student Book Pdf

Fm23 Statistics Manager Part 2 Reviving Eintracht Frankfurt With Island Might Fm Career Updates Sports Interactive Community

I7jhrrzgk3r8zm

Pztug6nh0zaybm

How Is Gate Score Scaled For 1000 Even If The Exam Is Written For 100 Quora

File Hp 32sii Rpn Scientific Calculator Front Lit From Upper Left 19679376452 Jpg Wikimedia Commons

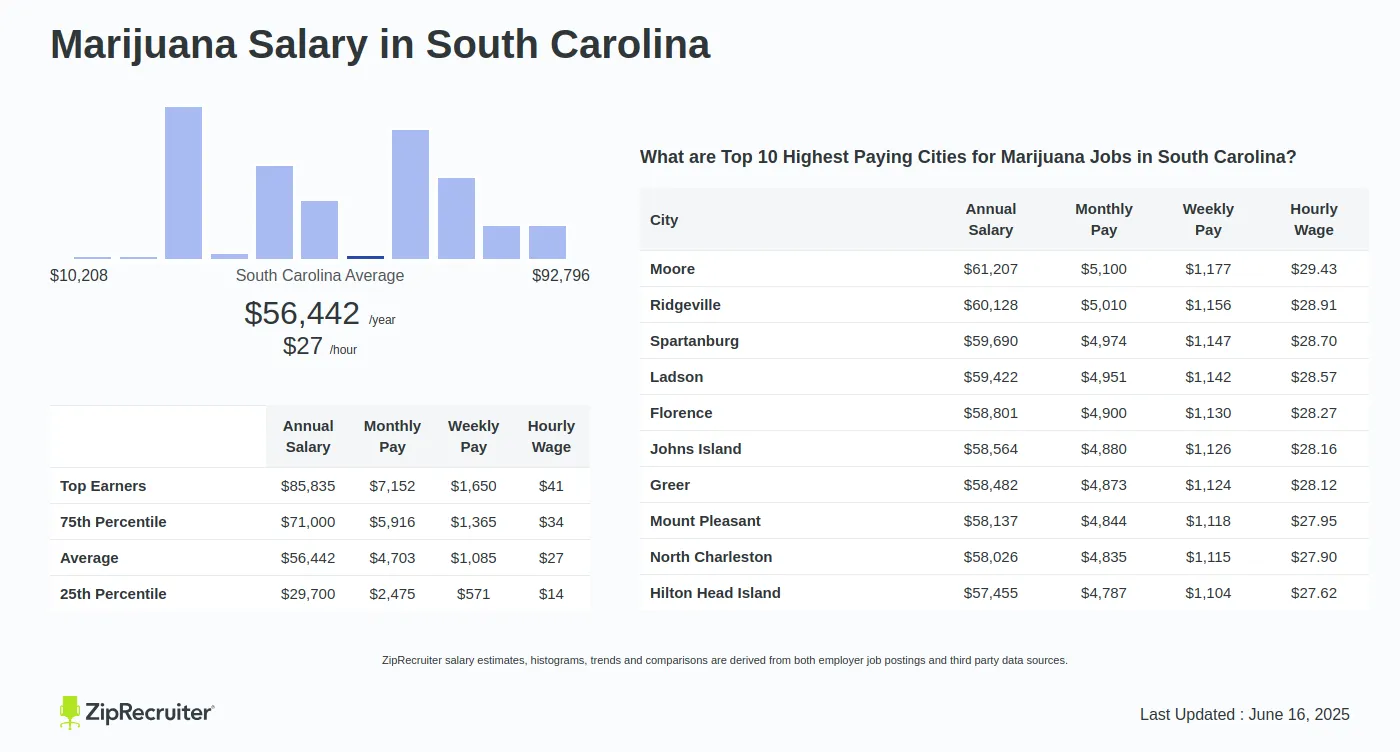

Marijuana Salary In South Carolina Hourly Rate Oct 2023

New Projects Near Barbeque Nation Hrbr Layout 2nd Block Kalyan Nagar Bengaluru 32 Upcoming Projects Near Barbeque Nation Hrbr Layout 2nd Block Kalyan Nagar Bengaluru

Gontents

Electric Circuits 8th Edition Solutions Manual Pdf Pdf

Pdf Longer Run Distributive Cycles Wavelet Decompositions For The Us 1948 2011

Pdf Fundamentals Of Mathematical Statistics A Modern Approach Raavana Kalki Academia Edu

Dryntl Qjhgrem

Marketing Is Finance Is Business How Cmo Cfo And Ceo Co Create Iconic Brands With Sustainable Pricing Power In The Galactic Age Ebook Burggraeve Chris Amazon In Kindle Store

South Carolina Paycheck Calculator Smartasset

Calameo The Trader 052113

Solved Deceleration Due To Gravity Is Given By H T 16t 2 Vt A Course Hero